There are significant bottlenecks in mining approval processes, ranging from the awarding of prospecting rights to WULs and environmental authorisations.

I spoke at the 2022 FFF Carbon conference. During the event, I noted that there are significant bottlenecks in mining approval processes, ranging from the awarding of prospecting rights to water use licences (WULs) and environmental authorisations.

The bureaucratic red tape delaying the development of new mining projects is largely not the fault of the Department of Mineral Resources. The departments of Environmental Affairs and Water do not issue licenses within the stipulated period and are delaying project developments owing to endless appeal processes.

The Minerals Council South Africa estimates that R90-billion in mining-related projects await the logjammed regulatory approval processes to be eased. Therefore, President Ramaphosa’s undertaking to cut the red tape is a welcome development.

Another challenge that mining companies face is that some nongovernmental organisations (NGOs), including some from foreign countries, had taken advantage of the red tape to block mining investment. These NGOs don’t care about the taxes that the state is losing when it delays mining investments.

Proving Critics Wrong

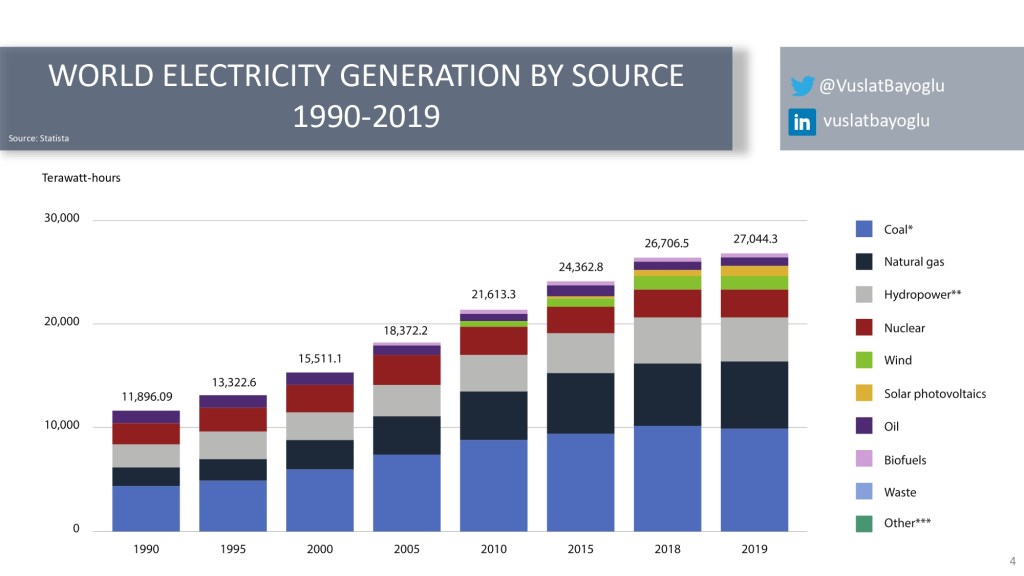

For decades there have been doom-filled forecasts about an imminent demise of oil and coal use, these have been proven resoundingly wrong. Oil production is crucial to world energy security and even Time Magazine, a liberal media publication, reported in December 2021, that the world generated more power from coal in 2021 than it had ever done so previously.

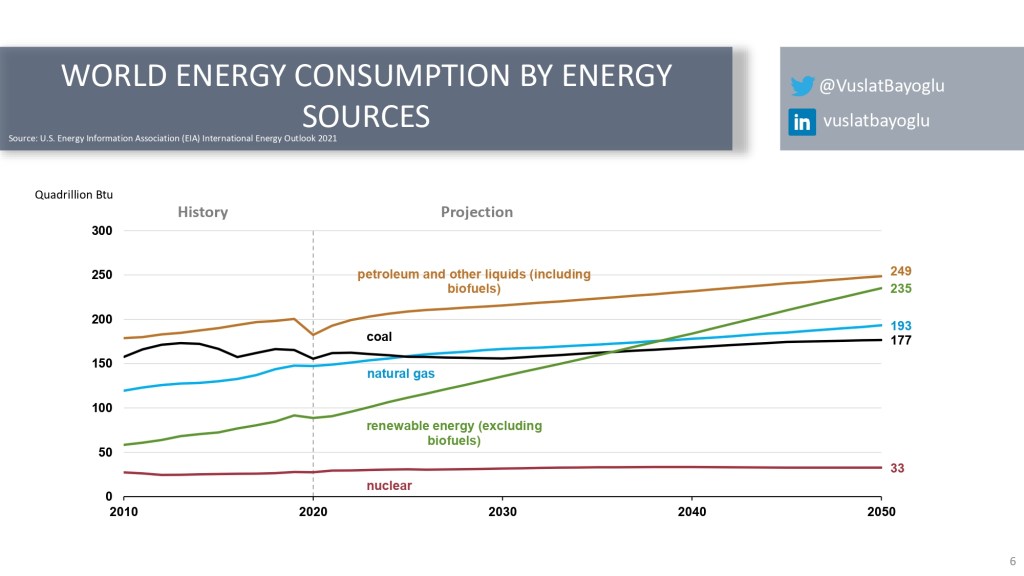

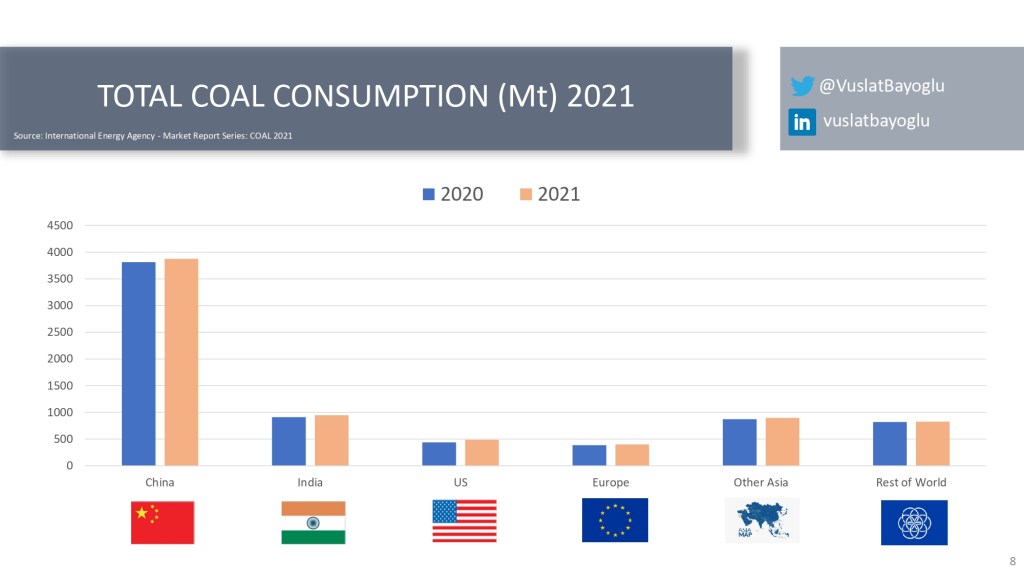

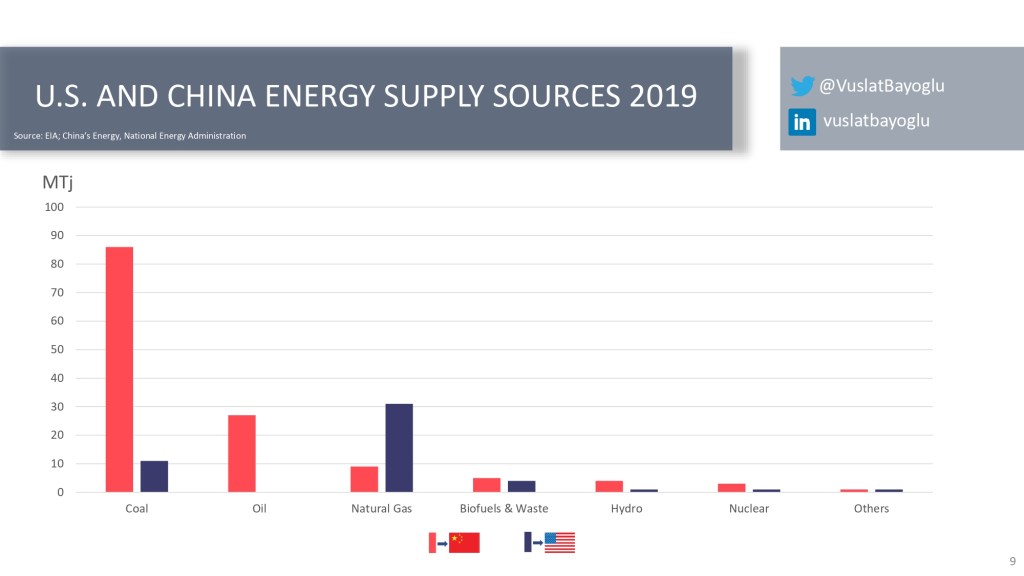

Energy demand has continued to increase exponentially with analysts forecasting global energy demand to reach 830 quadrillion BTU by 2050 with coal forecast to comprise 193 quadrillion BTU. Coal demand in China and India is robust and is forecast to continue to remain strong. Moreover, over 1 000 coal plants are currently being planned or under construction worldwide. Additionally, there are over 6500 operational coal plants worldwide that are dependent on coal. Coal demand even in places like Europe, where coal use has reduced in recent decades, is seeing a marked resurgence in light of energy uncertainty in Eastern Europe owing to Russia’s actions in Ukraine.

The global outlook for coal is good for South Africa. This is because the search for reliable energy sources like coal from South Africa could provide long-term opportunities for the South African coal mining sector if local logistical and regulatory challenges can be overcome.

Railway Challenges Impede Potential

South Africa has a world-class infrastructure. However, Transnet Freight Rail has experienced difficulties in providing trains to transport products to the Richards Bay Coal Terminal (RBCT), in KwaZulu-Natal. The decline in rail capacity should be cause for concern as coal exports have boosted the profitability of mining companies and contributed significantly to South Africa’s trade account.

RBCT’s exports have declined sharply in recent years, equating to billions in lost revenue. Coal export volumes for 2021 dropped to 58.2 million tons from, 70 million tons of coal exported in 2020.

We have to be hopeful that proposals by the government to bring in third-party, private partners to operate rail will become a reality soon. Access for third parties on the railway network is exactly what industry partners have been requesting for years.

View the presentation below:

Categories: Public Speeches